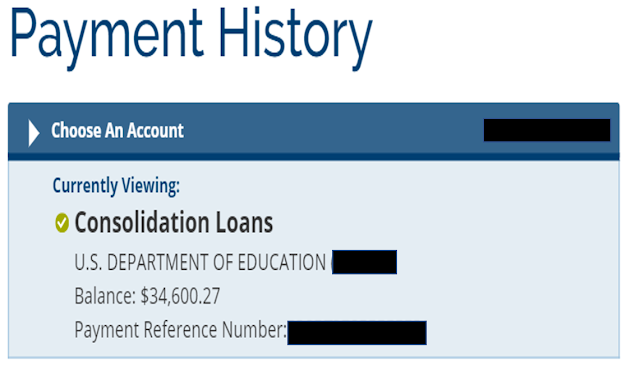

Student Loan Update:

I'm excited to post this update because I can finally say that I've paid off 50% of my student loans in 2018 and I'm on track to be debt free by August 2019. Perfect timing because I separate from the military a couple of months later. For the first time in my adult life, I will be positive net worth instead of negative, which means I can start working towards financial independence and early retirement. I can't think of a better way to start this new journey of creating a life I love than by being debt free.

Showing My Homework:

Check out that interest rate before I started my 13-month challenge. I was making the minimum monthly payment of $734 and nearly half of it was going to interest! No wonder I wasn't seeing any real difference in the overall balance.

Create a Plan and Work that Plan

- I lived on only 38% of my income. The rest went to my student loans. Aka I had a high savings rate. To learn how to do this I recommend Mr. Money Mustache, The Mad Fientist podcast, and BiggerPockets Money podcast. (Don't know how to listen to podcasts? Follow these instructions.)

- Everything in savings went to my student loans, except for the $1000 emergency fund.

- Liquidated all investments, except for retirement savings accounts.

- Want more on how I did it? Go to my latest post about how I'm living on $20K per year in San Diego.

- Also, here's a post on getting rid of those pesky credit cards that keep having you go over budget. It's called Letting Go of Temptation.

1. Create a budget.

2. Track your spending.

Me celebrating the actions I've taken towards my soon to be debt free future...

Next time I'll discuss the journey after becoming debt free and what financial independence looks like for me. For now, I'll leave you with a quote from Bill Gates about how he and Warren Buffet relate to work, which inspired my view of financial independence.

My Personal View of Financial Independence

Financial independence:

It's like "tap dancing to work" because you are freed from the constraints of having to work for money. It's no longer a job but instead an intentionally chosen passion that brings joy and purpose into your life.

Until next time,

KG

Comments

Post a Comment